Income Taxes By State Map

-

by admin

Income Taxes By State Map – If your combined income is between $25,000 and $34,000 (single filers) or between $32,000 and $44,000 (joint filers), up to 50% of your Social Security income can be taxable. If your combined income . Twelve states are reducing their individual income taxes this year, putting more money into many Americans’ pockets during a time of still-high inflation. .

Income Taxes By State Map

Source : taxfoundation.org

What Income Tax Subsidies Do States Offer to Seniors? – ITEP

Source : itep.org

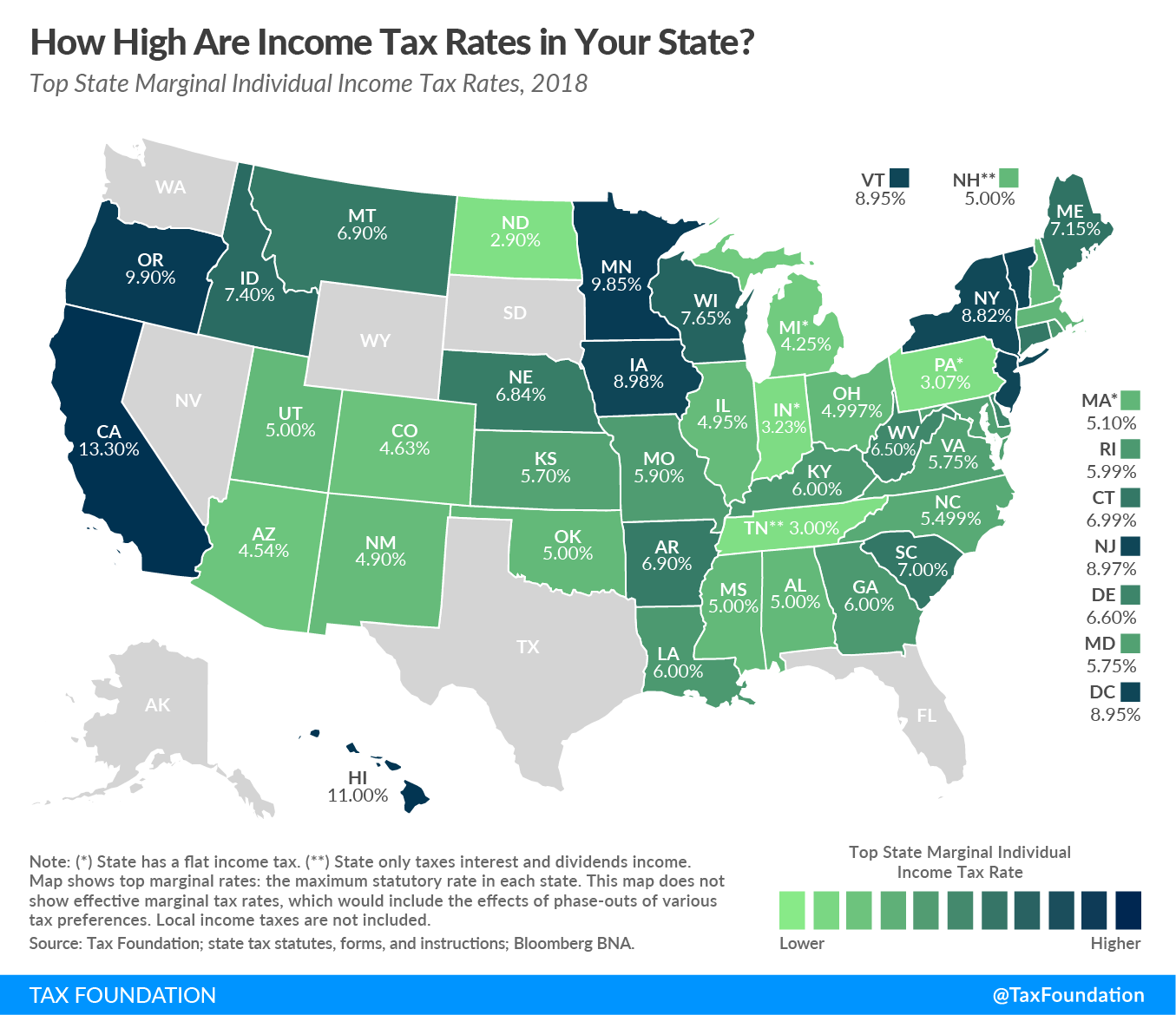

Monday Map: Top State Income Tax Rates

Source : taxfoundation.org

State income tax Wikipedia

Source : en.wikipedia.org

State Income Tax Rates and Brackets, 2021 | Tax Foundation

Source : taxfoundation.org

State Individual Income Tax Rates and Brackets for 2018

Source : taxfoundation.org

State Income Tax Reliance: Individual Income Taxes | Tax Foundation

Source : taxfoundation.org

State income tax Wikipedia

Source : en.wikipedia.org

Monday Map: Top State Income Tax Rates, 2013

Source : taxfoundation.org

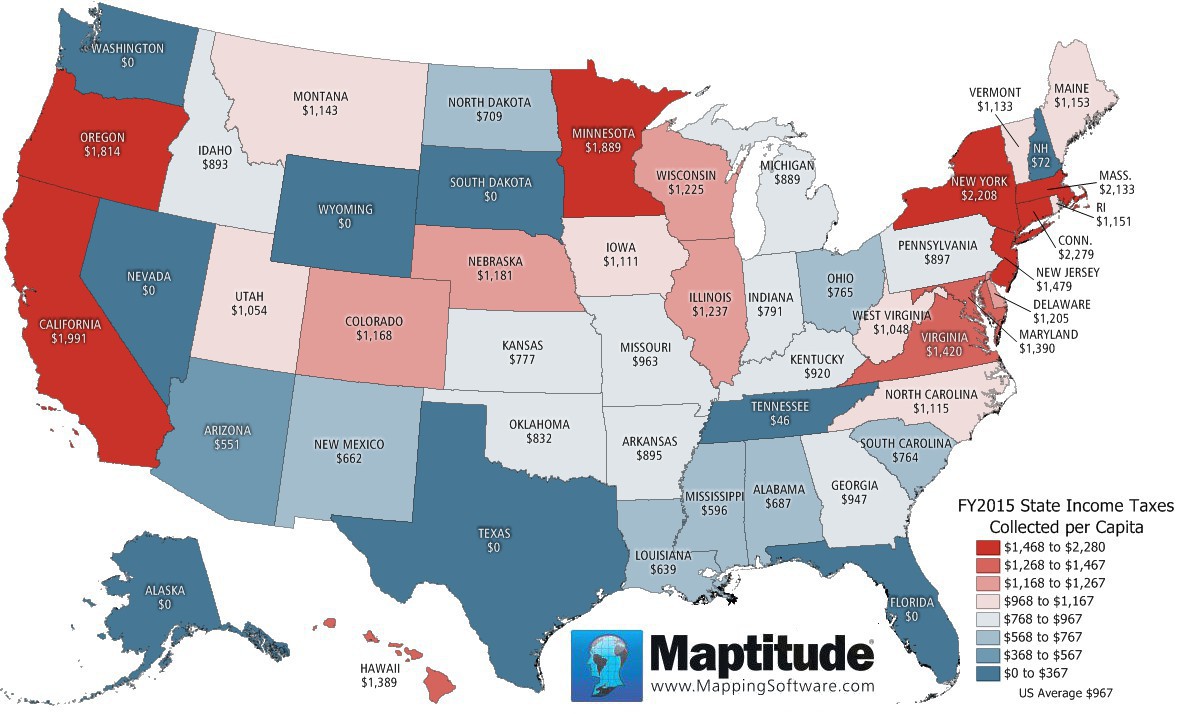

Maptitude Map: Per Capita State Income Taxes

Source : www.caliper.com

Income Taxes By State Map 2023 State Income Tax Rates and Brackets | Tax Foundation: Tax Analysts Chief Operating Officer Jeremy Scott reviews the 2023 developments in U.S. tax legislation and speculates what may lie ahead in 2024. . Income tax cuts take effect in a couple other states at the start of 2023 “You don’t have to be a geography expert to look at a map and recognize that we have Texas to our west, Florida .

Income Taxes By State Map – If your combined income is between $25,000 and $34,000 (single filers) or between $32,000 and $44,000 (joint filers), up to 50% of your Social Security income can be taxable. If your combined income . Twelve states are reducing their individual income taxes this year, putting more money into many…

Recent Posts

- Monaco On European Map

- United States Air Traffic Map

- Make A Zip Code Map

- Washington Dc Map With Airports

- Iceland Country World Map

- Bosnia And Herzegovina Map Of Europe

- World Map Dot Png

- Where Is Bulgaria On World Map

- New Franklin Ohio Map

- Interactive Weather Map Of The United States

- Map Of England Viking Times

- Lehigh Acres Power Outage Map

- Usa Map For Pictures

- Road Map Europe Route 2024

- Editable Map Of Us Free